Over the past couple of years, the Canadian real estate market has experienced significant shifts. One of the most eye-opening facts is that home prices have dropped by an average of 25% compared to two years ago. But what does this actually mean for buyers, investors, or homeowners looking to refinance?

In this blog post, we’ll break down the numbers, highlight the opportunity this presents, and explain why now might be the perfect time to make your move in the real estate market.

Prices Are Down by 25%: What Does That Mean?

According to recent market data (WOWA, FRED), home prices in Canada have dropped by an average of 25%. On the surface, this might not sound like much, but when you consider what that translates to in actual home values, the potential savings are shocking to many people.

Imagine this:

A home that sold for $1 million during the height of the pandemic would now sell (on average in Canada) for $750,000. That’s a massive $250,000 less — the equivalent of about three years’ worth of the average household income in Canada.

For buyers and investors, this decrease is nothing short of a game-changer, providing leverage that hasn’t been seen in a long time. Here’s why…

Real estate prices in Canada have dropped by 25% over the last two years. Sourced from wowa.ca.

The Historical Context: What Comes After Price Decreases?

Historically, after periods of significant price decreases in the housing market, long-term increases almost always follow. If we look at past market trends, it’s clear that while prices may dip, they eventually recover and then some.

Here’s why:

- Price Corrections: Real estate markets often experience corrections, but they are followed by extended periods of appreciation.

- Low Inventory: As prices begin to stabilize, demand starts to rise, pushing prices upward. And we still have a housing shortage in Canada on top of this.

- Economic Growth: As the economy strengthens, so does the housing market. Inflation has decreased to the target level, which has helped affordability overall (although it’s still difficult for most Canadians).

A graph depicting the historical housing prices of Canadian real estate from 1970 to 2024. Sourced from fred.stlouisfed.org.

Why This 25% Price Drop Is a Huge Opportunity

If you’re thinking about buying, investing, or even refinancing, now is the time to consider your options. Here’s why:

- Reduced Prices: With homes costing significantly less than they did two years ago, you can buy more house for less money.

- Better Investment Potential: With real estate historically increasing in value, purchasing now can mean higher returns in the future.

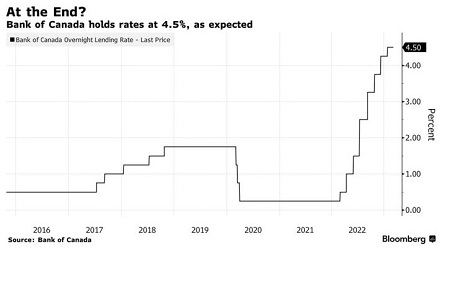

- Mortgage Rate Cuts: Canada has seen three consecutive rate cuts, and more are expected by the end of 2024 and into 2025. Lower rates, combined with lower prices, create a unique opportunity for buyers.

Whether you’re considering buying a new home, refinancing your existing mortgage, or investing in rental properties, the current market conditions offer unparalleled financial leverage.

How You Can Take Advantage of Lower Prices and Rates

The drop in home prices, paired with the recent rate cuts, means there are plenty of opportunities to make moves that were not available even a year ago. Here are a few options to consider:

Buying a New Home: Take advantage of lower prices and get a lower rate than you would have gotten just 6 months ago. You can also set yourself up to take advantage of rate cuts that are coming over the next months and year.

Refinancing Your Mortgage: Access your home equity while rates are falling. You can even go into a shorter term. Home equity is huge for paying off other debts, doing major renovations, or getting the money you need for a down payment on another home.

Investing in Real Estate: Whether it’s rental properties, vacation homes, or investment properties, now is a good time to buy when you consider where we were just 1-2 years ago.

Renewing Your Mortgage: For those with renewals in the next 4 months, make sure you’re taking into consideration the rate cuts. You should shop around because your current lender will likely not offer you their best rate and terms.

Looking Ahead: What Are Your Goals?

Now is the time to plan ahead. Whether your goals are short-term or long-term, having a strategy in place is crucial. Ask yourself:

- What do you want to achieve in the next year, three years, or five years?

- Could buying, refinancing, or investing help you reach those goals?

The current market conditions have created a window of opportunity that may not last much longer. Use this chance to position yourself for financial growth and success.

Conclusion: Don’t Miss This Opportunity

The real estate market has always been a sound investment, and today’s unique conditions make it even more attractive. With prices 25% lower and mortgage rates continuing to drop, this is a prime moment to act.

Whether you’re looking to buy, refinance, invest, or renew your mortgage, use a mortgage professional to help you navigate your options and make the best decision for your financial future. It’s the professionals that can show you how you can take advantage of opportunities like we have now.

Ready to explore your options? Contact me today to discuss how you can leverage the current market conditions to achieve your financial goals.